Posted on

June 21, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Alberta has the unlikely distinction of having Canada’s highest rental apartment vacancy rate and the most expensive average monthly rents. Alberta has the unlikely distinction of having Canada’s highest rental apartment vacancy rate and the most expensive average monthly rents.

The average monthly rent in Alberta for two-bedroom apartments in new and existing structures was $1,029, according to Canada Mortgage and Housing Corp.’s spring rental market survey released Thursday. That is up slightly from $1,023 a year ago. Alberta also had Canada’s highest vacancy rate at 4.7 per cent, down from 6.0 per cent a year ago. CMHC regional economist Lai Sing Louie said Alberta’s nation-leading average rental rates in the face of high vacancy are a holdover from rent increases which started kicking in during 2006 and 2007 as the provincial economy revved up and demand for housing soared. “It takes a lot for rents to come down,” Louie said. “A person who has invested in a rental project has cash-flow issues and other financial obligations that they have to meet. Everything is locked in and landlords tend not to reduce rents unless they absolutely have to keep tenants.” Instead of significantly cutting rents, landlords turned instead to incentives such as a month’s free rent to attract renters, Louie said. But incentives are on their way out as migrants begin returning to Alberta, spurring demand for housing, he said. In the Edmonton census metropolitan area, it was slightly tougher to find and a little more expensive to rent an apartment in the Edmonton region in April than it was a year ago. “A strengthening economy, especially in the energy sector, has improved labour market conditions in both (Edmonton and Calgary) CMAs,” said Richard Cho, a senior market analyst for the federal agency. “This has resulted in improved job creation, attracting an increased flow of migrants and strengthening the demand for rental units.” The apartment vacancy rate in the Edmonton census metropolitan area dipped to 4.7 per cent from 5.2 per cent in April 2010, the survey said. Average rent for a two-bedroom apartment in the Edmonton region rose to $1,029 from $994 a year earlier. In April 2009, the average two-bedroom rent in Edmonton was $1,059. Nationally, the average rental apartment vacancy rate in Canada’s 35 major centres decreased slightly to 2.5 per cent in April, from 2.9 per cent in April 2010. Read Full Story

Posted on

June 18, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

![MM900300524[1] MM900300524[1]](http://edmontonhousefinder.com/_media/blogging/Edmonton-Real-Estate-Market-Updates/MM9003005241thumb1DE1A64D1308423752450.gif) The wheels of economic growth are in motion in Alberta as the province reclaims its position as one of Canada’s fastest growing economies, says the latest Economic Outlook report released today by RBC Economics. The wheels of economic growth are in motion in Alberta as the province reclaims its position as one of Canada’s fastest growing economies, says the latest Economic Outlook report released today by RBC Economics.

The report forecasts Real GDP growth of 4.3 per cent in Alberta this year which will lead the country and economic growth of 3.8 per cent in 2012, which will be behind Saskatchewan’s nation-leading 4.7 per cent. Alberta’s economic growth this year will be its best showing since 2006 and an increase from the 3.7 per cent hike in 2010. “Strong demand for Alberta’s bitumen continues to spur tremendous activity in the province’s various oilsands projects,” says the report. “This activity more than makes up for weakness in natural gas and declining conventional oil output. Alberta’s oil and gas extraction producers are in midst of a $24.2-billion spending binge this year, boosting their outlays by nearly 18 per cent relative to 2010, according to intentions expressed in Statistics Canada’s Private and Public Investment survey released in February.” Read the full story

Posted on

June 15, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Calgary is ranked the ninth most expensive housing market in the country, according to the Coldwell Banker Real Estate Home Listing Report. The report, released Wednesday, is a snapshot survey of average listing prices for four-bedroom, two-bathroom homes in 70 Canadian markets over a six-month period from September 2010 to March this year on coldwellbanker.com. Calgary’s average came in at $534,912. Vancouver topped the country at over $1.546 million followed by Kelowna at $1.087 million and Burnaby at $797,455. Fort McMurray was fourth overall at $652,382 followed by West Kelowna ($640,055), Oakville ($624,914), Victoria ($540,087), and Surrey ($536,109). Sherwood Park rounded out the top 10 at $534,850. Leduc was 11th overall at $518,393. “The Canadian market continues to experience record or near-record housing prices in major markets across the country with Western Canada posting some of the nation’s highest prices,” said Jim Gillespie, chief executive of Coldwell Banker Real Estate. Edmonton placed 17th overall on the Canadian list with an average list price of $442,121. The most affordable market in Alberta was Lethbridge at $248,082. Read Full Story

Posted on

June 13, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

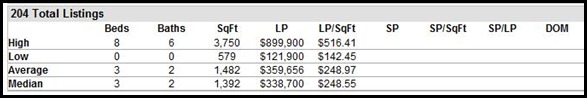

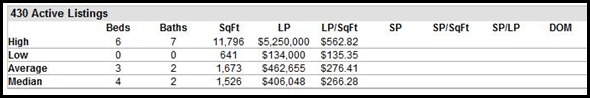

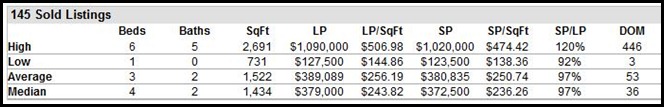

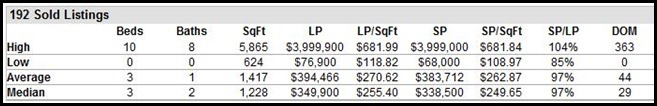

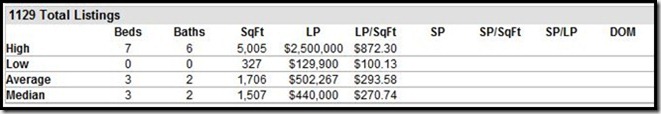

Zone 81 Zone 81

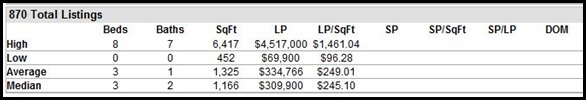

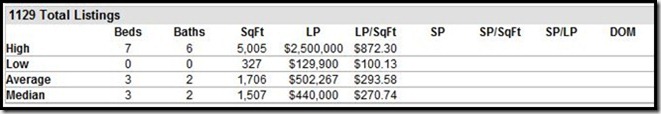

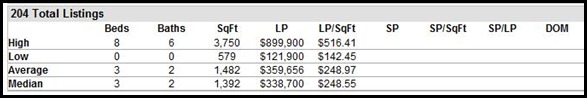

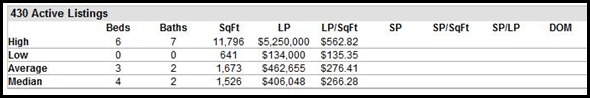

Leduc Homes for Sale Leduc Condos for Sale Current Active Homes For Sale in Leduc

Sold Homes – Leduc in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 12, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 82 Zone 82

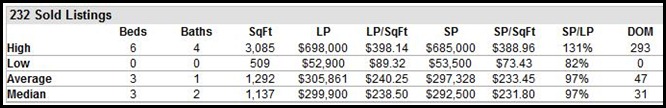

Beaumont Homes for Sale Beaumont Condos for Sale Current Active Homes For Sale in Beaumont

Sold Homes – Beaumont in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 11, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 24 Zone 24

Current Active Homes For Sale in St. Albert

Sold Homes – St. Albert in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 10, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

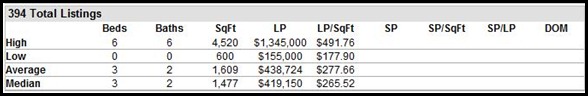

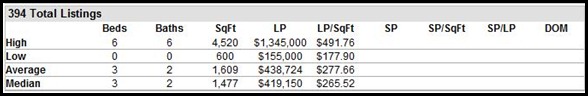

Zone 25 Zone 25

Current Active Homes For Sale in Sherwood Park

Sold Homes – Sherwood Park in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 10, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

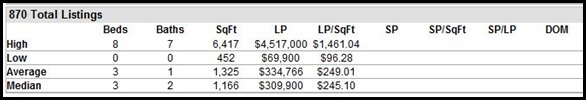

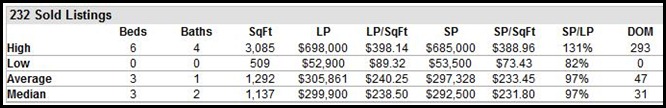

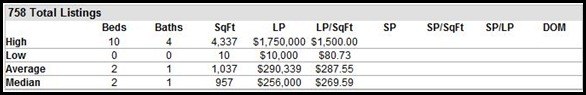

Zone 02 - Evansdale, Northmount, Glengarry, Klikenny, Kildare, Delwood, Mcleod, York, Zone 02 - Evansdale, Northmount, Glengarry, Klikenny, Kildare, Delwood, Mcleod, York,

Cassleman, Miller, Balwin, Belvedere, Killarney, Elmwood Park, Dalton Zone 03 - North Swale, Matt Berry, Hollick Kenyon, Brintnell Zone 06 - Newton, Montrose Zone 09 - Highlands, Edmonton Northlands, Virginia Park, Cromdale Zone 23 - Berman, Abbotsfield, Beacon Heights, Beverly Heights, Rundle Heights Zone 28 - Ozerna, Mayliewan, Belle Rive, Eaux Claite, Schonsee, Klarvatten, Lago Lindo, Crystallina Nera, Joviz Zone 35 - Kirkness, Fraser, Hairsine, Clareview Campus, Bannerman, Sifton Park, Belmont, Kernohan, Homesteader,Overlanders, Canon Ridge Zone 43 - Clover Bar Area, East Edmonton Zone 50 - Zone 51 - Current Active Listings in Northeast Edmonton

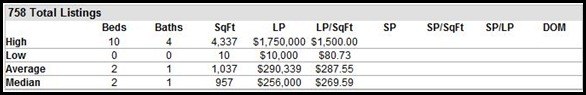

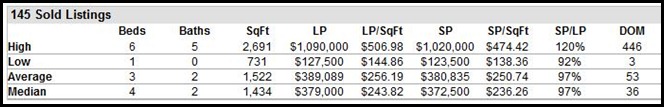

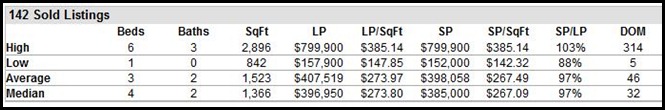

Sold Listings in Northeast Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 9, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 01 - Athlone, Calder, Kensington, Lauderdale, Rosslyn, Wellington Zone 01 - Athlone, Calder, Kensington, Lauderdale, Rosslyn, Wellington

Zone 04 - Dovercourt, Hagman Est Ind, Prince Charles, Sherbrooks Zone 07 - Inglewood, North Glenora, Westmount, Woodcroft Zone 21 - Britannia,/Youngstown, Canora, Grovenor, High Park/Edm, Jasper Place, Mayfield, McQueen Zone 27 - Barnow, Batyrn, Beaumaris, Caenarvon, Canossa, Carlisle, Carlton, Chambery, Cumberland, Dunluse, Elisnore, Hudson, Lorelei, Oxford, Palisades, Pembina, Rapperswill, Rural North West Zone 59 - Rural West Big Lake, Westview Village, Mobile Park, Winterburn Ind East Zone 40 - Current Active Listings in Northwest Edmonton

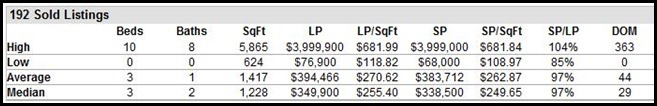

Sold Listings in Northwest Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 8, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

The local real estate market is humming along at a steady rate with home prices remaining relatively stable for single-family dwellings in both St. Albert and Morinville. “Prices for May are slightly less than they were last year, but up significantly from January,” said Jon Hall, communications manager for the Edmonton Real Estate Board. Hall agreed it’s not unusual and is in fact a normal market trend for houses to rise in price through the first six months of every calendar year. He also stressed there are enough positive signs of an improving economy to provide an optimistic outlook for the re-sale housing market. “The market is fairly stable with a slight upward trend and no wild swings in prices. There is nothing in the local market causing those swings and on the future horizon there is optimism with companies such as Ledcor, which just announced last week it’s hiring 9,000 people,” he said. Read Full Story

Posted on

June 8, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Housing starts in the Edmonton region for May surpassed May 2010 levels, Canada Mortgage and Housing Corp. said Wednesday. CMHC said there were 1,009 homes started in May, up from 989 a year earlier. It’s the highest level of monthly activity since April 2010, the federal agency said. But for the year to date, housing starts totalled 3,332, down from 4,428 in the first five months of 2010. There were 546 single-detached homes started in May, up slightly from 540 a year earlier. It’s the first year-over-year gain since September. For the year to date, builders started 1,783 single-detached units, down 30 per cent from 2,554 year-over-year. CMHC senior market analyst Michael Fabiyi said the number of completed and unabsorbed homes remains higher than last year, but the total supply of single-detached homes has declined over recent months. “This, along with the higher pace of absorptions recorded thus far should encourage increased new home production moving forward,” he said. In the multi-family market, there were 463 starts in May, up from 449 a year earlier. In the first five months of 2011, multi-family starts totalled 1,549. That’s down 17 per cent from January to May 2010. Across Alberta, housing starts in the seven largest centres dropped eight per cent year-over-year to 1,948 in May Read Full Story

Posted on

June 8, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 5 - Alberta Avenue, Delton, Eastwood, Elmwood Park, Park Dale Zone 5 - Alberta Avenue, Delton, Eastwood, Elmwood Park, Park Dale

Zone 08 - Central McDougall, Edmonton Municipal, Prince Rupert, Queen Mary Park, Spruce Avenue, Westwood, Yellowhead Corridor Zone 12 - Downtown Edmonton, Oliver, Rossdale Zone 13 - Boyle Street, McCauley, Riverdale Current Active Listings in Central Edmonton

Sold Listings in Central Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 7, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 10 - Crestwood, Parkview, Valleyview, Laurier Heights Zone 10 - Crestwood, Parkview, Valleyview, Laurier Heights

Zone 11 - Glenora Zone 20 - Aldergrove, Belmead, Callingwood, Dechene, Donsdale, Gariepy, Hawthorne Hill, Jamieson Place, Le Perle, Lymburn, Ormsby Place, River Valley Ctry, Sherwood, Summerlea, Terra Losa, Thorncliffe, Vistula, Westridge Zone 22 - Emwood, Glenwood, Jasper Park, Lynwood, Meadowlark Park, Oleskiw, Patricia Heights, Quesnell Heights, Rio Terrace Zone 58 - Breckenridge, Greens, Glastenbury, The Hamptons, Normandeau Gardens, Potter Green, Lewis Estates, Triple A Acres Current Active Listings in West Edmonton

Sold Listings in West Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 6, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 17 - Argyll, Avonmore, Hazeldean, King Edward Park, Ritchie. Zone 17 - Argyll, Avonmore, Hazeldean, King Edward Park, Ritchie.

Zone 18 - Bonniedoon, Cloverdale, Holyrood, Idlewylde, Kenilworth, Ottwell, Strathearn. Zone 19 - Capilano, Forest Heights, Fulton Place, Gold Bar, Terrace Heights, Millwoods. Zone 29 - Bisset, Crawford Plains, Daly Grove, Ekota, Greenview, Hillview, Jackson Heights, Kameyosek, Kiniski Gardens, Lee Ridge, Mensia, Mayonohk, Michaels Park, Millwoods Park, Minchau, Pollard Meadows, Richfield, Sakaw, Satoo, Tawa, Tipaskan, Tweddle Place, Weinlos Zone 30 - Larkspur, The Meadows, Silver Berry, Wildrose Zone 41 Zone 42 Zone 53 Zone 54 Current Active Listings in South East Edmonton

Sold Listings in South East Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 5, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge. Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge.

Zone 15 - Allendale, Belgravia, Empire Park, Garneau, Grandview Heights, Landsdown, Lendrum Place, Malmo Plains, McKernan, Park Allen, Pleasant View, Queen Alexandra, Strathcona, Windsor Park. Zone 16 - Aspen Gardens, Royal Gardens, Rideau Park, Duggan, Greenfield, Westbrook Estate, Sweet Grass, Blue Quill Estates, Steinhauer, Ermineskin, Skyrattler, Keheewin, Twin Brooks, and Bearspaw. Zone 55 - Blackburne, MacEwan, and Richford Zone 56 - Windermere Estates Zone 57 - Woodbend Estatesh Edmonton South West Homes for Sale Edmonton South West Condos for Sale Current Active Listings in South West Edmonton

Sold Listings in South West Edmonton in May 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 3, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Edmonton, June 2, 2011: The local real estate market is looking up according to the current statistics released by the REALTORS® Association of Edmonton. The average residential sales price is up, the price of a single family detached home or a condo is up, number of sales is up and inventory is up over the previous month. “Local market housing sales this year are tracking as we forecast in January,” explained REALTORS® Association of Edmonton President Chris Mooney. “Historically for the month of May, the days-on-market (50 days) is at the second lowest point in four years while the sales-to-listing ratio at 53% is at the second highest point in the same period. Both metrics are a good indication of market optimism.” The average* price of a single family detached home in May was $380,545, up a quarter of a percent from last month. An average priced condo sold for $241,079, up an amazing 3.65% from April. Duplex and row house prices declined 2.96% month-over-month but the average residential price (including all types of residential properties) was up 1.39% from a month ago. Median prices in most housing categories were up: SFD up 1.13%, condo up 3.64%, Duplex/row house down 2% and all residential up 0.8%. There were 1,857 residential sales in May (up 24.9% from April) with listings of 3,525 properties (up from 3,278 in April). As a result, inventory increased from 7,715 properties to 8,180. “There is a wide range of property on the market right now but it is turning over quicker than in recent months,” said Mooney. “The local economy is picking up, the demand for labour is increasing but the national situation is keeping interest rates low. We anticipate increasing prices and sales through the summer ahead as we originally forecast.” Total Edmonton and area MLS® System sales in May were $701 million for an annual total-to-date of $2.574 billion. Highlights of MLS® System activity | May 2011 activity | Record for

the month* | % change from

May 2010 | | Total MLS® System sales this month | 2,080 | 3.27% | | Value of total MLS® System sales - month | $701 million | 1.53% | | Value of total MLS® System sales - year | $2.57 billion | -9.40% | | Residential¹ sales this month | $616 million | 1.23% | | Residential average price | $331,974 | -2.42% | | SFD² average selling price - month | $380,545 | -2.48% | | SFD median³ selling price | $357,000 | -2.19% | | Condo average selling price | $241,079 | -2.96% | ¹. Residential includes SFD, condos and duplex/row houses.

². Single Family Dwelling

³. The middle figure in a list of all sales prices * Average prices indicate market trends only. They do not reflect actual changes for a particular property, which may vary from house to house and area to area. Prior period figures have been adjusted to include late reported sales and cancellations and therefore reflect a more accurate view of the period than previously reported at month end. For information on a specific area, contact your local REALTOR®.

Posted on

May 31, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Canada’s big banks have cut their residential mortgage rates, likely for the last time in the foreseeable future, economists say. The bank cut rates by one-tenth of a percentage point on mortgages terms ranging from one to 10 years. That puts the rate for a five-year closed mortgage at 5.49 per cent at each of Canada’s major banks. The Bank of Montreal, Royal Bank of Canada, TD Canada Trust, and Scotiabank announced reductions last week. Canadian Imperial Bank of Commerce followed suit on Monday. Long-term interest rates are falling because of concerns about the health of the global economy, coupled with the likelihood that the Bank of Canada will hold off on raising its key overnight rate until well into the second half of this year. Read Full Story

Posted on

May 31, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

The Bank of Canada kept its key interest rate unchanged at 1% on Tuesday but for the first time since the recession it said it would eventually have to lift borrowing costs if economic growth continues. “To the extent that the expansion continues and the current material excess supply in the economy is gradually absorbed, some of the considerable monetary policy stimulus currently in place will be eventually withdrawn, consistent with achieving the 2% inflation target,” it stated. “Such reduction would need to be carefully considered. It did not say whether “eventually” meant the next rate increase would be in July, September or beyond, but its statement was more hawkish than previous ones, which only said that any future hikes “would need to be carefully considered.” The central bank now sees underlying inflation as only “relatively subdued” rather than “subdued” as in previous statements, but it did not change its overall outlook for inflation. It repeated that the persistent strength of the Canadian dollar “could create even greater headwinds for the Canadian economy” and dampen inflation. Read Full Story

Posted on

May 30, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Fewer new homes will go up in Edmonton this year before the residential construction industry recovers to pre-recession heights next year, said Canada Mortgage and Housing Corp. Monday. Total housing starts in the Edmonton census metropolitan area for 2011 will not repeat the comeback of 2010, which saw a gain of 56 per cent, the Spring 2011 Edmonton Housing Market Outlook said. Builders will start 9,250 homes in 2011, down seven per cent from 2010. But economic growth and more in-migration will lift housing starts by 9.2 per cent in 2012 to 10,100 units, CMHC said. “Next year’s performance will represent the best year for the homebuilding industry since 2007,” CMHC senior market analyst Richard Goatcher said. Following 2010’s gain, single-detached starts in 2011 will decrease by nine per cent to 5,500 homes. In 2012, singles will rebound to near 6,000 — but still below the 10-year average of 6,177. The report said multi-family starts will reach 3,750 units in the Edmonton CMA in 2011. That’s four per cent down from 2010. In 2010, multi-family starts soared by 61 per cent as new-apartment construction took off. In 2012, the forecast calls for multiple starts to approach 4,100, up nine per cent over the previous year. In the resale market, the report predicts Multiple Listing Service activity in greater Edmonton will remain mostly flat at 16,500 sales, following a 14-per-cent drop in 2010. “Despite a slow first quarter, look for demand to improve as the year progresses due to an improving economy and a slightly tighter rental market which will encourage more newcomers to consider home ownership,” Goatcher said. In 2012, the report forecasts MLS sales to keep rising by more than four per cent to 17,200 units. The average residential price will rise by only 0.1 per cent in 2011 to $329,000, with most gains in the latter half of the year. A more balanced market will push the average residential price up by 2.4 per cent year-over-year in 2012 to $337,000. In the apartment rental market, the vacancy rate will drop by October to 3.8 per cent, down from 4.2 per cent last October. CMHC forecasts vacancy will fall again in 2012 to 3.0 per cent. Tighter vacancies will mean rising rent, CMHC said. The average two-bedroom rent remained stable at $1,015 in 2010, but will rise $15 in 2011. Read Full Story

Posted on

May 28, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Alberta’s energy-driven economy staged a strong comeback last year, and this year the province’s employers are expected to steadily increase hiring. This will attract new residents to the region and put an upward pressure on the housing supply. Read Full Story

|

Alberta has the unlikely distinction of having Canada’s highest rental apartment vacancy rate and the most expensive average monthly rents.

Alberta has the unlikely distinction of having Canada’s highest rental apartment vacancy rate and the most expensive average monthly rents. ![MM900300524[1] MM900300524[1]](http://edmontonhousefinder.com/_media/blogging/Edmonton-Real-Estate-Market-Updates/MM9003005241thumb1DE1A64D1308423752450.gif)