Posted on

September 3, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

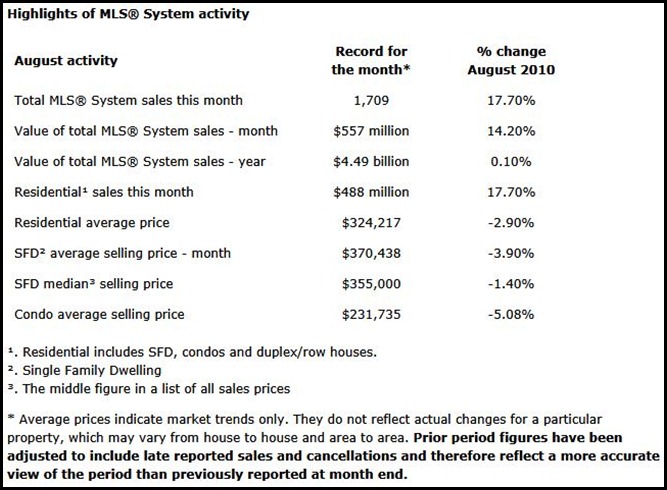

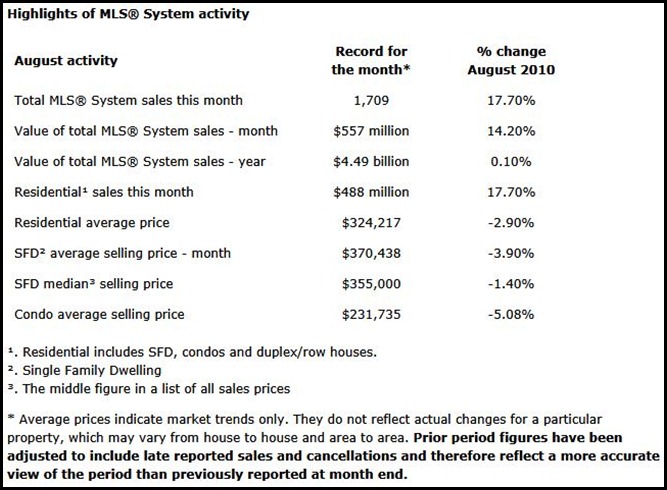

The average* price of a single family home has remained remarkably stable for the past four years according to figures released by the REALTORS® Association of Edmonton. The average selling price in August has varied from a high of $372,000 in 2008 to the low of $367,700 in 2009. Last month SFDs sold on average for $370,438. Prices have varied within a range of just over one percent. “Consumers are wary in the face of uncertainty in the global economic markets and they receive constant reminders from federal officials about the dangers of carrying too much debt. Other real estate markets have seen recent boom and bust cycles that are not evident in our local market,” said REALTORS® Association of Edmonton President Chris Mooney. “Residential property is holding its value and the economic prospects for the Alberta and Edmonton markets show real growth potential in the next few years.” Condo prices have slipped seven percent since 2008 because of an oversupply and lack of demand resulting from tighter mortgage qualification rules. In August 2008, the average price for a local condo was $248,000. This past August it was just $231,735. Overall, the all residential price has varied from $329,600 in 2008 to $324,217 this year (August figures). In August 2011, there were 969 single family homes reported sold through the Multiple Listing Service® with 428 reported condo transactions with a total of 1,507 reported sales of all types of residential property. There were 1,564 total residential sales in July 2011 reflecting the typical pattern of slower sales as we head into fall. “A stable market place and slightly lower prices combined with a slower sales cycle means that there are homes available in all price ranges,” said Mooney. “The residential median price ($315,000) remained almost the same as the previous month while the average prices dropped. This indicates that there is a softening of prices at the upper end of the market. Under these conditions, sellers with property priced below the average price for their property type and location will attract more attention and get a quicker sale.” The sales to listing ratio notched up four percent to 51% as a result of steady listing activity and the typical sales cycle stretched to an average of 57 days-on-market indicating slower sales in August.

Posted on

September 3, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge. Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge.

Zone 15 - Allendale, Belgravia, Empire Park, Garneau, Grandview Heights, Landsdown, Lendrum Place, Malmo Plains, McKernan, Park Allen, Pleasant View, Queen Alexandra, Strathcona, Windsor Park. Zone 16 - Aspen Gardens, Royal Gardens, Rideau Park, Duggan, Greenfield, Westbrook Estate, Sweet Grass, Blue Quill Estates, Steinhauer, Ermineskin, Skyrattler, Keheewin, Twin Brooks, and Bearspaw. Zone 55 - Blackburne, MacEwan, and Richford Zone 56 - Windermere Estates Zone 57 - Woodbend Estates Edmonton South West Homes for Sale Edmonton South West Condos for Sale Current Active Listings in South West Edmonton

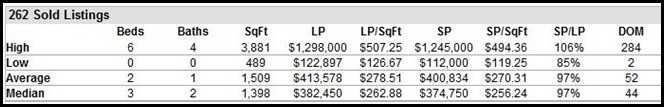

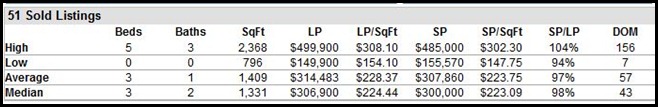

Sold Listings in South West Edmonton in August 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

August 31, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Canada’s national housing agency says the country’s real estate industry will be strong in the back half of the year, building on favourable economic conditions in the first six months of 2011. Canada Mortgage and Housing Corp., in a report accompanying its quarterly earnings, said Monday that mortgage rates near historic lows and improvements in employment have led to fewer claims under its mortgage insurance business despite higher home prices. CMHC insurance protects lenders against default. The agency said it expected fixed mortgage rates to stay relatively flat for most of the year, with the five-year posted rate at between 4.1 per cent and 5.6 per cent, then increase slightly in 2012, while variable rate mortgages would remain near historically low levels. But prices of homes shown on the Multiple Listing Service are expected to grow slightly going forward because the resale market is likely to stay in balanced territory. Meanwhile, CMHC said changes to mortgage rules introduced by the federal government earlier this year played a part in reducing mortgage interest payments and allowed Canadians to build equity in their homes faster. Canadians are finding it easier to pay off their mortgages, with arrears levels improving and the volume of mortgage insurance claims lower than expected. Read Full Story

Posted on

August 27, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

As of September 1, 2011, home inspection businesses and individual home inspectors must obtain a licence from the provincial government. Qualifications for a home inspector licence - Inspectors must have a degree, diploma or certificate in home inspection from an approved educational institution and successfully complete a test inspection. The government currently recognizes the Carson Dunlop & Associates curriculum offered by SAIT and will evaluate other courses that become available in Alberta.

- Inspectors are automatically qualified for a licence if they hold a Registered Home Inspector designation from the Canadian Association of Home and Property Inspectors; or a Certified Master Inspector designation from the Master Inspector Certification Board, Inc., affiliated with the International Association of Certified Home Inspectors.

- Inspectors who do not meet these requirements may apply for a conditional licence valid until March 31, 2013 to give them time to acquire the necessary qualifications.

Standards for home inspections

The Home Inspection Business Regulation establishes basic requirements that home inspections must include, unless the consumer specifically agrees otherwise. Inspections must address the condition of a home’s: - roofing, flashings or chimney;

- exterior, including lot gradings, walkways, driveways, retaining walls, patios and decks;

- structure;

- electrical;

- heating, heat pumps and cooling;

- insulation;

- plumbing; and

- interior.

Inspectors can make recommendations on any deficiencies they identify, such as suggesting the consumer obtain an expert opinion, but are prohibited from estimating the cost of any repairs or improvements.

Posted on

August 24, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

“Housing starts have been strong in the last few months, but are forecast to moderate closer in line with demographic fundamentals,” said Mathieu Laberge, Deputy Chief Economist for CMHC. “Despite recent financial uncertainty, factors such as employment, immigration and mortgage rates remain supportive of the Canadian housing sector.” “Housing starts have been strong in the last few months, but are forecast to moderate closer in line with demographic fundamentals,” said Mathieu Laberge, Deputy Chief Economist for CMHC. “Despite recent financial uncertainty, factors such as employment, immigration and mortgage rates remain supportive of the Canadian housing sector.”

Housing starts will be in the range of 166,300 to 197,200 units in 2011, with a point forecast of 183,200 units. In 2012, housing starts will be in the range of 161,700 to 207,200 units, with a point forecast of 183,900 units. Existing home sales will be in the range of 425,000 to 472,500 units in 2011, with a point forecast of 446,700 units, essentially the same level as in 2010. In 2012, MLS®2 sales are expected to move up modestly in the range of 407,500 to 510,000 units, with a point forecast of 458,000 units. The average MLS® price increased in the first half of 2011 partly as a result of more higher-end homes sold during that period. For the remainder of 2011, the average MLS® price is expected to moderate. Nevertheless, the annual average MLS® price will experience an overall increase in 2011 compared to last year. As the existing home market moves to more balanced markets, growth in the average MLS® price in 2012 is expected to be more modest. Read Full Story

Posted on

August 23, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

With a regional economy buoyed by the oil and gas sector and an average single family home price of $384,656 in 2011, Edmonton homebuyers have an open window. Research released Monday by RBC Economics Research shows a person buying a home in Edmonton would spend 33.8% of their household income on owning a home, on average. That’s up just over half a percent, and still lower than Calgary’s 37.1% - and one of the most affordable housing markets in the nation. Chris Mooney, president of the Realtors Association of Edmonton (RAE), likes the numbers. “The numbers show that Edmonton, from an affordability perspective, is one of the national leaders. In terms of being a major municipality, having over a million residents in the metro Edmonton area and having prices as affordable as they are is a real blessing for Edmonton, I think,” Mooney said. “The last time I checked, Edmonton was running $100,000 less than Calgary,” he said. “I think that’s an indicator of how lucky we are in Edmonton.” The real estate industry keeps an eye on rental industry numbers, and a lower vacancy rate is encouraging, spurred by a warm oil and gas sector, Mooney said. “In a market like ours where we’re seeing a lot of in-migration of labor, that’s a strong indicator of future sales ... foretelling further activity in the residential market,” he said, predicting a “bump” in real estate sales within a year. Keeping an eye on the real estate bubble that burst in 2008, according to RAE figures, in Edmonton the residential sales volume year-to-date has decreased from almost $5 billion in 2007 to $3.4 billion in 2011; however the number of sales is almost the same, near the 1,450 mark, which means the sales-to-listing ratio is up from 36% to 47%. Sales are taking longer, with the average days on market up at 51 days in 2011 from 30 in 2007. In Edmonton, the average single family home price shrank from $415,860 in 2007 to $384,656 in 2011. The average condo price went from $274,379 in July 2007 to $224,225 in July 2011. Read Full Story

Posted on

August 5, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge. Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge.

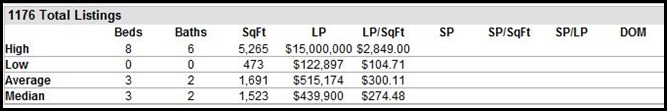

Zone 15 - Allendale, Belgravia, Empire Park, Garneau, Grandview Heights, Landsdown, Lendrum Place, Malmo Plains, McKernan, Park Allen, Pleasant View, Queen Alexandra, Strathcona, Windsor Park. Zone 16 - Aspen Gardens, Royal Gardens, Rideau Park, Duggan, Greenfield, Westbrook Estate, Sweet Grass, Blue Quill Estates, Steinhauer, Ermineskin, Skyrattler, Keheewin, Twin Brooks, and Bearspaw. Zone 55 - Blackburne, MacEwan, and Richford Zone 56 - Windermere Estates Zone 57 - Woodbend Estatesh Edmonton South West Homes for Sale Edmonton South West Condos for Sale Current Active Listings in South West Edmonton

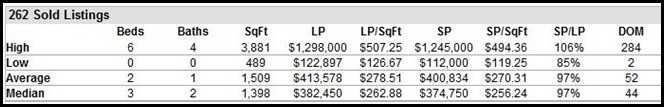

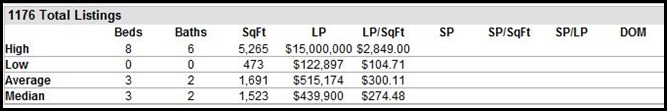

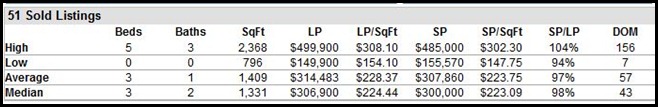

Sold Listings in South West Edmonton in July 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

August 3, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

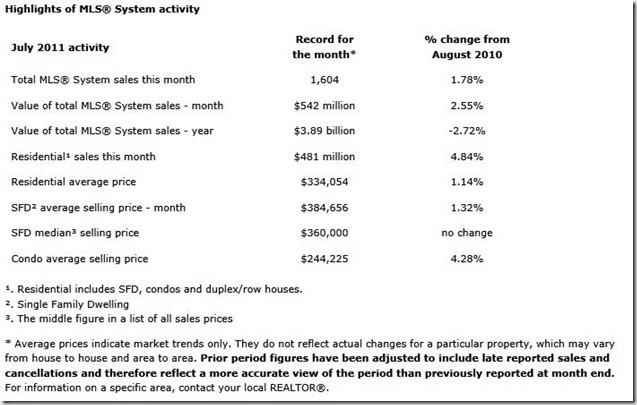

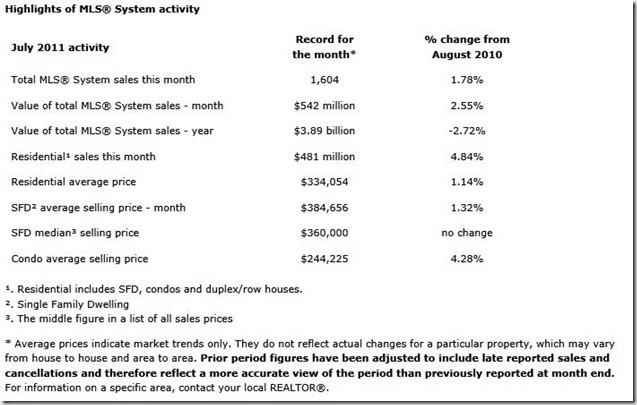

According to the REALTORS® Association of Edmonton, the average price of housing increased through July as compared to the previous month. The all-residential average price increased 1.1% to $334,054; up from $330,298 in June. Single family home prices increased 1.3% while condo prices rose 4.3% during the month. Residential sales in July were 1,441 up 3.6% compared to the same time last year. Residential listing activity dropped slightly in July to 3,038 units; down 210 units from June but up 193 units from the same time last year. The inventory of homes on the Multiple Listing Service® is quickly approaching par from last year at 8,421 properties available as of July 31. “Our local housing market is quite healthy with affordable prices, a good inventory and strong sales,” said REALTORS® Association of Edmonton President Chris Mooney. “The selection of properties on the market for buyers is excellent. With employment opportunities popping up throughout the region and interest rates being very attractive, now is a good time to purchase a property in Edmonton.” The average* price of a single family detached home in July was $384,656 with a median price of $360,000. Condo average price was $244,225 with a median of $223,000. Duplex and rowhouse prices rose on average from $296,969 to $309,816, a 4.3% increase. “The increase in housing prices is on track with our January forecast and as we move into fall, we don’t see prices increasing substantially,” said Mooney. The average days-on-market in July was 51 days: the same as in July 2010. The residential sales-to-listing ratio was 47% in July and total MLS® System sales were over $3.887 billion for the year so far.

Posted on

July 20, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 5 - Alberta Avenue, Delton, Eastwood, Elmwood Park, Park Dale Zone 5 - Alberta Avenue, Delton, Eastwood, Elmwood Park, Park Dale

Zone 08 - Central McDougall, Edmonton Municipal, Prince Rupert, Queen Mary Park, Spruce Avenue, Westwood, Yellowhead Corridor Zone 12 - Downtown Edmonton, Oliver, Rossdale Zone 13 - Boyle Street, McCauley, Riverdale Central Edmonton Homes For Sale Central Edmonton Condos For Sale Current Active Listings in Central Edmonton

Sold Listings in Central Edmonton in June 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

July 17, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 81 Zone 81

Leduc Homes for Sale Leduc Condos for Sale Current Active Homes For Sale in Leduc

Sold Homes – Leduc in June 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

July 15, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

According to statistics released today by The Canadian Real Estate Association (CREA), home sales activity over MLS® Systems of Canadian real estate Boards climbed in June 2011 compared to May. Highlights: - Sales activity climbed from May to June, with a big year-over-year gain reflecting falling demand in June 2010.

-

- Year-to-date sales remain in line with the ten-year average.

-

- The number of newly listed homes also rose from May to June.

-

- National housing market remains firmly entrenched in balanced territory.

-

- National average price still being skewed upward by the value of sales in expensive Vancouver neighbourhoods, with price gains in other markets providing additional loft.

Read Full Story

Posted on

July 12, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 25 Zone 25

Sherwood Park Homes For Sale Sherwood Park Condos For Sale Current Active Homes For Sale in Sherwood Park

Sold Homes – Sherwood Park in June 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

July 8, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Economic and other external indicators point to a strengthening of the local real estate market according to the REALTORS® Association of Edmonton. - Statistics Canada reported that Alberta boasted the highest spike in population in the first quarter with a 0.4% increase.

- The Conference Board of Canada predicts that housing prices in Edmonton will increase from five to seven percent in the short term although local prices are currently down when compared to last year.

- Although the Bank of Canada seems reluctant to raise interest rates because of the negative impact on exports, CMHC reports that Canadians are budgeting for an interest rate hike.

- While housing prices nationally are up by 8.6% (May figures) Edmonton prices are tracking predictably in a stable market.

- CIBC is of the opinion that Alberta home prices are over-valued by 17% yet RBC names Edmonton amongst the most affordable major metro markets in Canada.

- A report by Peters and Co. forecast that $180 billion will be spent on new oilsands projects in the next decade with current oilsands operations and maintenance adding another $30 billion a year.

“The various reports and indicators can be confusing and contradictory,” said REALTORS® Association of Edmonton President Chris Mooney. “Alberta and Edmonton are often moving in a different direction than the rest of the country and a national statistic or trend may not apply here. REALTORS® are very optimistic about the current market and are prepared to help home buyers and sellers sort through the figures to determine the best housing strategy for each individual or family.” In the first half of the year the average* price of a single family detached home has risen from $357,540 to $379,409 while the all-residential price has risen from $308,497 to $330,297. However compared to the same-month year-over-year, prices have risen consistently between the levels set in the past two years. In the short term, when compared to the previous month, prices in June were generally stable. Single family homes were up 0.31% from $378,239 to $379,409. Condo prices dropped from $239,782 to $231,852 (down 3.3% after rising 3.1% in May). Duplex and row house prices climbed slightly from $295,334 to $296,689. The all-residential average price dipped 0.5% during the month of June. There were 1,768 residential sales in June with 3,260 listings resulting in a sales-to-listing ratio of 54%. This is compared to 53% in May. There are currently 8,432 residential properties in the MLS® System inventory and days-on-market is slower at 53 days (up from 50 in May). “We know that all real estate is local and homeowners and buyers should focus on local data and local expertise to guide their decisions,” said Mooney. “Is it a good time to buy a home in Edmonton? If your domestic needs have changed and you need to move, then seek professional advice and start the process.”

Posted on

July 7, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Edmonton's residential real estate market saw sales pick up in June while prices lagged compared to June 2010. Edmonton's residential real estate market saw sales pick up in June while prices lagged compared to June 2010.

Residential MLS sales finished at $584 million for the month, up 7.6 per cent from a year earlier, according to new figures from the Realtors Association of Edmonton. There were 1,768 residential sales in June with 3,260 listings for a sales-to-listing ratio of 54 per cent. That compares with 1,619 residential sales in June 2010 with 3,339 listings, for a sales-to-listing ratio of 48 per cent. The June residential average price dipped half a percentage point to $330,297 year-over-year. Single-family MLS sales rose 15.1 per cent to 1,165 homes from 1,012 in June 2010. The average single-family home selling price for June was $379,409, down 2.86 per cent year-over-year. The median single-family selling price was $361,888, up about one per cent year-over-year. Condo sales in June remained flat with 482 sales, just below 486 sold a year earlier. But the average condo selling price finished at $231,852, down more than five per cent year-over-year. Read Full Story

Posted on

July 2, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 17 - Argyll, Avonmore, Hazeldean, King Edward Park, Ritchie. Zone 17 - Argyll, Avonmore, Hazeldean, King Edward Park, Ritchie.

Zone 18 - Bonniedoon, Cloverdale, Holyrood, Idlewylde, Kenilworth, Ottwell, Strathearn. Zone 19 - Capilano, Forest Heights, Fulton Place, Gold Bar, Terrace Heights, Millwoods. Zone 29 - Bisset, Crawford Plains, Daly Grove, Ekota, Greenview, Hillview, Jackson Heights, Kameyosek, Kiniski Gardens, Lee Ridge, Mensia, Mayonohk, Michaels Park, Millwoods Park, Minchau, Pollard Meadows, Richfield, Sakaw, Satoo, Tawa, Tipaskan, Tweddle Place, Weinlos Zone 30 - Larkspur, The Meadows, Silver Berry, Wildrose Zone 41 Zone 42 Zone 53 Zone 54 Edmonton South East Homes For Sale Edmonton South East Condos For Sale Current Active Listings in South East Edmonton

Sold Listings in South East Edmonton in June 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

July 1, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge. Zone 14 - Brander Gardens, Brookside, Brookeside, Buylea Heights, Carter Cresc, Falconer Heights, Haddow, Henderson Estates, Hodgson, Legar, Ogilvie Ridge.

Zone 15 - Allendale, Belgravia, Empire Park, Garneau, Grandview Heights, Landsdown, Lendrum Place, Malmo Plains, McKernan, Park Allen, Pleasant View, Queen Alexandra, Strathcona, Windsor Park. Zone 16 - Aspen Gardens, Royal Gardens, Rideau Park, Duggan, Greenfield, Westbrook Estate, Sweet Grass, Blue Quill Estates, Steinhauer, Ermineskin, Skyrattler, Keheewin, Twin Brooks, and Bearspaw. Zone 55 - Blackburne, MacEwan, and Richford Zone 56 - Windermere Estates Zone 57 - Woodbend Estatesh Edmonton South West Homes for Sale Edmonton South West Condos for Sale Current Active Listings in South West Edmonton

Sold Listings in South West Edmonton in June 2011

DOM = Days on the Market LP = List Price SP = Sold Price

Posted on

June 28, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

During the real estate boom in the mid-2000s, Edmonton's suburbs grew by leaps and bounds. They grew out of sight, almost unnoticed by folks in mature neighbourhoods, until the Anthony Henday opened and drivers looking for a shortcut to Calgary spotted rows and rows of rooftops from the highway. Today, as economic forecasts predict the city is about to boom again, the Edmonton Journal is launching a summer series on Edmonton's newer communities. The city predicts 75 per cent of growth will be in new communities for at least the next decade. More than 40 neighbourhoods are already approved or under construction, some filling up faster than others, and a closer look shows a large variance in the quality and level of amenities. Read Full Story

Posted on

June 26, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Economic risks, well-anchored inflation expectations and a strong Canadian dollar have prompted TD Economics to push back its interest rate hike forecast. Rather than an increase from the Bank of Canada in 2011, TD now believes the tightening of monetary policy will arrive early in 2012, with the overnight rate climbing to just 2.00% by the middle of the year. “With the U.S. Federal Reserve on hold, the Bank of Canada is also constrained in raising interest rates, as widening interest rate spreads would boost the Canadian dollar that is already above parity,” said Craig Alexander, TD’s chief economist. He also said the traditional framework for thinking about monetary policy fails to account for the atypical economic and financial environment that currently exists. “At the most basic level, the world economy has not made as much progress as we had hoped in dealing with the legacies of the financial crisis and recession,” Mr. Alexander said in a report. “This will have an impact on the future conduct of Canadian monetary policy.” He thinks Canada’s central bank could raise rates from 1.00% to 2.00%, then stop to assess how the economy responds and how international events are playing out. The economist said such a pause would last several months. If this more accomodative policy stance leads to stronger domestic demand, this would induce the need for higher rates, Mr. Alexander said. The other factor that could change his outlook is inflation. “If solid economic data leads markets to fret about the Bank falling behind the inflation curve, then all bets are off and the central bank will start hiking,” he said. “The credibility of an inflation fighter is too valuable to lose.” Read Full Story

Posted on

June 23, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

Doubts that the Albertan economy could reclaim its position as one of Canada’s faster growing provincial economies are dissipating quickly because the wheels of growth are starting to spin faster in the province. Doubts that the Albertan economy could reclaim its position as one of Canada’s faster growing provincial economies are dissipating quickly because the wheels of growth are starting to spin faster in the province.

To be sure, not all economic sectors have yet displayed the same pace of recovery—or any recovery at all in some cases—but we believe that the expansion is spreading and will bring wider benefits as 2011 progresses. The forest fires that tragically destroyed communities and disrupted crude oil production in May will, fortunately, have only a temporary effect on overall economic performance. We expect growth to accelerate to a nation-leading 4.3% in 2011 from 3.7% in 2010, which would be the province’s best showing since 2006. Read Full story

Posted on

June 22, 2011

by

Bill Bhamra, REALTOR® Edmonton Homes for Sale

You better buy a house in this market before it's too late. You better buy a house in this market before it's too late.

How many times have you heard those words? The panic thinking is driven partially by prices continuing to rise to record levels but also by the sense that near-record-low interest rates could rise at any moment. The sense of desperation to buy now out of fear you won't be able to get it tomorrow is probably one of the first things taught to any sales person. Create a sense of urgency. "There's six left on the shelf, nope, it's down to five," jokes certified financial planner Ted Rechtshaffen, president of TriDelta Financial. "It's an interesting phrase." Mr. Rechtshaffen says his clients are not uttering panic words but you have to wonder whether Mark Carney, governor of the Bank of Canada, might have been hearing them before making a speech to the Vancouver Chamber of Commerce this month. "One cannot totally discount the possibility that some pockets of the Canadian housing market are taking on characteristics of financial asset markets, where expectations can dominate underlying forces of supply and demand," Mr. Carney said. "The risk is that expectations become extrapolative, prompting the classic market emotions of greed and fear -greed among speculators and investors -and fear among households that getting a foot on the property ladder is a now-or-never proposition." It's hard to measure desperation, but a recent survey from Toronto-Dominion Bank on first-time homebuyers might imply there is some urgency in the marketplace. The survey found 45% of Canadians are willing to buy their home independently without a co-signer. Traditionally people wait until they are married to buy that first home but now they want to establish equity early so they can get their foot in the market. More worrisome out of the TD report was the statistic that buyers are doing less research before jumping in. The bank said mortgage pre-approvals are down to 72% from 84% a year ago and home inspections have dropped from 85% to 67% during the same period. The report also shows declining percentages for buyers researching issues like electricity and closing costs. It all sounds like somebody in a hurry to buy or at least in a bit more of a rush. "I think people see affordability is still there. The employment numbers are strong and rates are relatively still low," says Farhaneh Haque, regional manager of mobile mortgage specialists with TD Canada Trust. "In part there is a sense or urgency because they are worried about rates and unsure of what the markets will do." Benjamin Tal, deputy chief economist at CIBC World Markets, says the Bank of Canada is partly to blame for some of the urgency in the market because of the uncertainty over rates. "People feel the window is closing," Mr. Tal says. "People have been talking about the Bank of Canada raising rates. They look and say rates will be one or 1.5% [percentages points higher] next year. There is some logic to it." He adds that if you look at trends over the past 20 years on what happens before rate announcements, you see an acceleration of activity before the announcement. "Look at the last year and half and we've had this sense of urgency," says Mr. Tal, adding it has driven housing in Canada since the recession. "The real estate market has like nine lives." It's easy to say wait until the market crashes in cities like Vancouver, where prices are up 25% from a year ago. But if rates go up, it could be just as expensive to carry a home. Queen's University professor John Andrew says it's in the real estate industry's interests to promote the idea prices will rise forever. But while he thinks it's obvious in places like Vancouver there will be a price correction, it doesn't help you if interest rates go up. "You see a 10% price correction but if interest rates go up two [percentage points], you are not better off," Prof. Andrew says. "Buyers are caught in this quandary that when interest rates go up, prices will come down." If you are sitting on the housing sidelines, it might seem like you can't win either way. Read Full Story

|